Crypto trading involves buying, selling, or holding cryptocurrencies (or digital currencies) to generate a profit from fluctuations in their price in the short, medium, or long term.

Trading on dedicated platforms can involve exchanging fiat currencies, such as the US dollar (USD), Euro (EUR), and the Canadian dollar (CAD) for cryptocurrencies or exchanging one cryptocurrency, such as Bitcoin (BTC), Ethereum (ETH), or Litecoin (LTC), among others, for another. These operations require specific knowledge, particularly in strategy, analysis, and risk management.

What is Crypto Trading?

Crypto trading consists of speculating on the price of cryptocurrencies by buying and selling them through a platform called an “exchange”. The principles and concepts of classic trading can be applied to the cryptocurrency market, which is very similar to Forex’s operation.

However, digital assets have unique specificities that are important to consider in trading strategies and techniques.

What is a cryptocurrency?

A cryptocurrency is a digital asset that operates on a floating exchange rate through a listing on specialised platforms. Although there are many different types of cryptocurrencies, they all have one thing in common: they operate on blockchain technology.

The most well-known and valuable cryptocurrency to date is Bitcoin (BTC), used as a store of value in the manner of “digital gold.” Ethereum is the second-largest cryptocurrency in terms of capitalisation.

Characteristics of the cryptocurrency market

The cryptocurrency market is decentralised, meaning that digital currencies operate on a network of computers and are not backed by a central authority. The technology underlying cryptocurrencies is blockchain, which is a decentralised, peer-to-peer distributed ledger technology.

Unlike other markets, they are listed and tradable 24/7, which offers great flexibility to traders thanks to the absence of time constraints and overnight gaps (price shifts when the markets reopen).

The most important cryptocurrencies are very liquid and tradable either directly (by actually owning the token in a dedicated wallet) or via derivative products such as Contracts for difference (CFDs), exchange-traded funds (ETFs), or Futures.

How to get started in crypto trading?

Beyond the specificity of cryptocurrencies and their trading discussed above, certain particularities must be considered before embarking on crypto-trading with systems like Immediate Edge.

What are the prerequisites for crypto trading?

As with any other trading activity, crypto trading requires a dedicated allocation of funds. In addition, a specially tailored trading plan, including the intended guidelines and strategies, can be prepared in advance.

Security, leverage, and taxation of crypto-trading

It is essential to secure accounts. With digital assets, if an account is hacked or wallet access codes are misplaced, the funds held will be lost forever. There is often no way to recover them, so security is important. Two-factor authentication (2FA) processes, and other best practices like solid passwords are essential.

Some platforms offer margin trading or derivative contracts with exceptionally high leverage. Finally, cryptocurrency trading is taxable. Capital gains become taxable in some countries when cryptocurrencies are converted into traditional currencies. The calculations can be complex, and taxation depends on the different states.

How to trade cryptocurrencies?

Before placing your first orders, you must choose an exchange platform and open an account, providing the necessary data and documents. Then, you must choose the digital currencies to trade to place orders.

Choose an exchange

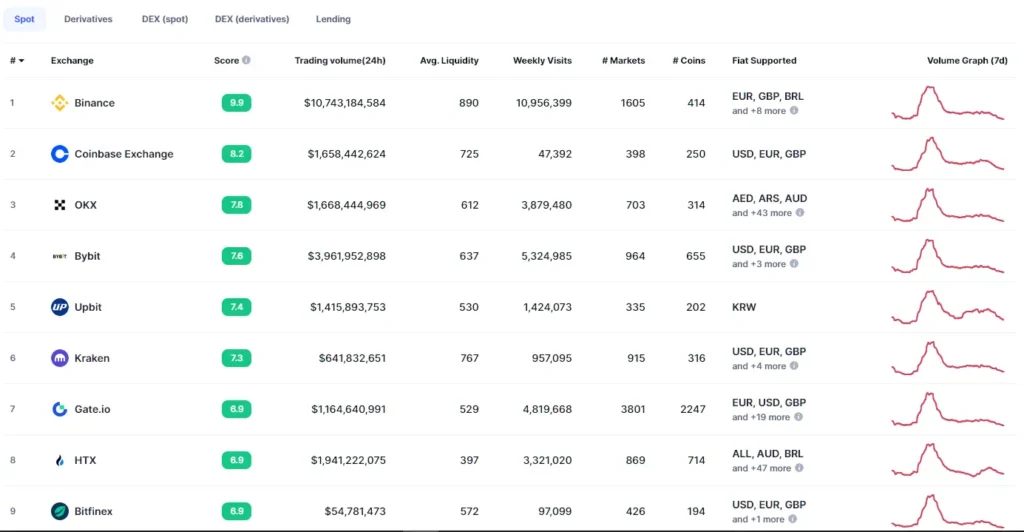

Platforms, or “exchanges,” can be hacked, hence the importance of choosing recognised players. Crypto exchanges specialised in crypto trading, such as Binance, Coinbase and Kucoin, allow crypto-trading with suitable tools.

Which cryptocurrencies to trade and how to place an order

There are many tradable cryptocurrencies, each with its variation factors. Different types of analysis exist to choose an asset to trade based on opportunities. To transact with cryptocurrency, you need to have a set of public and private keys. These keys transfer cryptocurrencies from one account to another or a chosen recipient.

In crypto trading, these keys are unnecessary: placing orders within your account on the chosen platform is a matter of placing orders within your account. Platforms generally offer an intuitive interface with several types of orders, such as market orders, limit orders, and OCO (One Cancels the Over) orders, which allow, in particular, the setting up protection orders to limit losses and withdrawal profits on predetermined levels.

Crypto Trading Strategies

Crypto trading involves buying and selling cryptocurrencies to make a profit; several strategies can be implemented depending on each trader’s constraints and objectives.

Cryptocurrency scalping

Cryptocurrency scalping is a strategy that involves taking advantage of small market movements, entering and exiting trades quickly over a day, an hour, or even a few seconds. This technique is relatively safer than other trading strategies. Since it looks for small movements, it can exit the trade anytime. This technique allows users to control the amount of their profits and losses.

Using this strategy, the Trader must observe the charts closely and stay close to the trading terminal to react quickly to market changes.

The importance of fast and effective strategies cannot be overstated in cryptocurrency trading, where rapid financial gains or losses can occur suddenly.

Fundamentals of Scalping

To successfully scalp crypto, traders must consider several key elements:

- Time Horizons: Scalpers typically work on very short time horizons, ranging from a few seconds to a few minutes. This allows them to capitalise on small price movements.

- Volatility: Scalpers thrive on volatility. They look for assets with frequent price fluctuations, such as Bitcoin.

- Liquidity: Liquidity is crucial to make quick transactions without significant price slippage.

- Risk Management: Scalpers should set strict stop-loss and take-profit orders to protect their capital.

- Technical Analysis: Charts, patterns, and indicators must be analysed to identify entry and exit points.

Why Choose Your Online Trading Platform for Crypto Scalping?

A renowned online trading platform offers several features ideal for crypto scalping:

- Fast Execution: The online platform ensures ultra-fast order execution, allowing scalpers to enter and exit their positions quickly.

- Advanced Charting Tools: The platform offers a range of technical analysis tools and indicators, helping traders make informed decisions.

- Real-Time Market Data: Access to real-time market data is essential for scalping, and the online platform provides just that.

- Low Fees: The platform’s competitive fee structure reduces the impact on scalpers’ profits.

- User-Friendly Interface: The user-friendly interface ensures traders can navigate the platform quickly and efficiently execute trades.

Scalping Strategies

Momentum Scalping

- Momentum scalping involves trading in the direction of the prevailing trend. Traders identify short-term trends and aim to profit from rapid price movements.

- The online platform provides traders with real-time trend analysis tools, making it easier to spot potential momentum changes.

Range Scalping

- Range scalping takes advantage of sideways price movements. Traders identify support and resistance levels and make quick trades within that range.

- The online platform offers tools to help traders identify price ranges and set appropriate entry and exit points.

News Scalping

- News scalping takes advantage of significant events that can potentially move markets. Traders anticipate price increases or decreases following news releases and act quickly.

- The online platform provides real-time news feeds and alerts, allowing traders to stay informed and make quick decisions.

V. Risk Management

Stop-Loss Orders

- The online platform allows traders to set precise stop-loss orders to limit potential losses and protect their capital.

- Scalpers should set stop-loss levels based on risk tolerance and asset volatility.

Position Sizing

- Scalpers should determine their position sizes based on their account size and risk tolerance.

- The online platform offers position sizing calculators to help traders make informed decisions.

Trading Discipline

- Decisions based on emotions can lead to losses. Scalpers using the online platform should be strictly disciplined and stick to their predefined strategies.

- Developing and sticking to a trading plan is essential for long-term success.

Risks of Scalping

High Stress

- Scalping can be emotionally demanding due to making quick decisions and constantly monitoring the market.

- The platform offers features to reduce stress, such as automated trading options.

Trading Costs

- Frequent transactions may incur high fees and commissions.

- The platform offers competitive fees to help mitigate this risk.

Crypto scalping is a high-risk, high-reward trading strategy that requires precision and quick decision-making. Traders interested in implementing scalping strategies can find a reliable platform with the tools and features to succeed. While the potential for quick profits in a fast-moving market is tempting, traders must develop a solid understanding of Bitcoin, the market, and risk management. With the online platform as their trading partner, Bitcoin scalpers can confidently navigate this demanding landscape. In this fast-paced world of cryptocurrency trading, it is clear that the online platform offers a valuable resource for those looking to make quick profits through scalping. However, scalping success mainly depends on the trader’s skill, discipline, and ability to adapt to the ever-changing market conditions. With the right approach, crypto scalping can be lucrative for those who dare to face its challenges.

Day Trading and Swing Trading on Cryptocurrencies

Compared to day trading (which involves entering and exiting positions within the same day) and position trading (consisting of holding positions for a longer period), swing trading falls in between. It involves holding positions for a period ranging from a few days to a few weeks. This strategy uses a combination of technical and fundamental factors to formulate its trading ideas. With this particular type of trading, decisions can be made with less haste and more rationality, unlike day trading, which requires quick decisions and execution.

What are the swing trader’s tools?

The swing trader mainly uses two types of analysis:

- Technical analysis: This is the daily bread of the swing trader. It is based on:

- Trend indicators like moving averages or MACD

- Oscillators such as RSI or Stochastic

- Graphical analysis with supports, resistances, and chart patterns

- Fundamental analysis: Although less crucial, it remains essential. The swing trader keeps an eye on the following:

- Economic news

- Financial reports of companies

- Major geopolitical events

How to set up an effective and sustainable swing trading strategy?

Here is a detailed review of the three most popular and effective swing trading strategies:

1. Trading in the direction of the trend

This strategy capitalises on strong directional market movements.

Detailed steps:

- Identify a strong trend on a daily chart

Use moving averages (e.g., 20 and 50 periods) to confirm the direction

Look for higher highs and higher lows for an uptrend (reverse for a downtrend)

- Expect a short-term pullback

Look for a 38.2% to 61.8% correction (Fibonacci levels) of the last impulse

Observe a decrease in volume during the pullback

- Enter the position when the price resumes the main direction

Wait for a reversal candle or a break of minor resistance

Confirm with a volume increase

- Place a stop-loss below the last low (for an uptrend)

Typically, 1-2 ATR (Average True Range) below the entry point

Adjust for asset volatility

- Aim for a goal with a risk/reward ratio of at least 1:2

Use Fibonacci extensions or previous resistance levels as potential targets

Consider moving your stop-loss to the entry point once the trade is in profit

2. Range trading

This strategy exploits sideways market movements.

Detailed steps:

- Identify a well-defined trading range

Look for at least two touches of support and resistance

Check that the range represents at least 5% of the asset value

- Buy near support and sell near resistance

Wait for a bounce confirmation on the support (for a purchase)

Look for signs of rejection near resistance (for sale)

- Use Oscillators to Confirm Market Conditions

RSI below 30 may indicate an oversold condition (buying opportunity)

RSI above 70 may indicate an overbought condition (selling opportunity)

- Place stop-losses just outside the range

For a buy, place the stop-loss just below the support

For a sell, place the stop-loss just above the resistance

3. Breakout trading

This strategy aims to capture the moves that follow a consolidation breakout.

Detailed steps:

- Identify a consolidation figure (triangle, rectangle, etc.)

Look for well-defined figures with at least 2-3 touches of each level

The longer the pattern, the more powerful the potential breakout.

- Wait for a breakout with a significant volume

Volume should ideally increase by at least 50% compared to the average

Confirm the breakout with a close above the breakout level

- Enter in the direction of the breakout

Place a limit order just above the breakout level for a bullish breakout

Place a limit order just below the breakout level for a bearish breakout

- Place a stop-loss just below the breakout point

For a bullish breakout, place the stop-loss just below the low of the breakout candle.

Place the stop-loss just above the high of the breakout candle for a bearish breakout.

- Aim for a goal based on the height of the figure

Measure the height of the figure and project it from the breakpoint

Adjust the target based on critical support/resistance levels

What are the benefits and challenges of swing trading in today’s environment?

Advantages of swing trading:

- Time flexibility

- Requires less constant monitoring than day trading

- Allows you to keep a full-time job while trading

- Less stressful than day trading

- Reduces the pressure of quick decisions

- It provides more time to analyse and confirm setups

- Allows you to take advantage of medium-term trends

- Capturing more significant moves than day trading

- Less sensitive to daily market noise

- Reduction of transaction costs

- Fewer trades mean fewer commissions

- Potentially improves overall profitability

Challenges of swing trading in the age of volatility:

- Exposure to overnight gap risk

- Open positions are vulnerable to price gaps between sessions

- Requires careful management of positions and trade sizes

- Influence of unforeseen events

- Economic or geopolitical news may impact open positions

- Requires constant vigilance on relevant news

- Need for strong discipline

- Requires strict adherence to a trading plan

- Requires patience to wait for optimal setups

- Managing emotions over more extended periods

- Longer trades can intensify stress and anxiety

- Requires vital emotional mastery and solid trading psychology

Arbitrage and Automated Trading on Cryptocurrencies

Arbitrage is one of the most common trading strategies. A trader buys a cryptocurrency when its price is lower on one platform and “simultaneously” sells it on another platform where the price is higher. The cryptocurrency market is not entirely efficient because they are subject to the laws of supply and demand on each platform they are listed. This, therefore, implies possible differences in the pricing of the same cryptocurrency on different platforms. Arbitrage traders exploit these differences to make a profit and, at the same time, allow prices to balance out.

Another popular and widely used trading strategy is automated trading. Automated trading robots are computer programs that can sell and buy cryptocurrencies independently.

The main goal of these robots is to produce maximum profits for their users. These robots open and close positions automatically by constantly monitoring the market and reacting to a specific set of predetermined rules (strategy). Depending on the user’s preferences, these robots can analyse market criteria such as price, volume, or orders.

How to analyse cryptocurrencies

To implement these strategies, the Trader can use various analysis tools to identify opportunities and determine entry and exit points for positions. These tools include charts, possibly accompanied by technical indicators. Fundamental analysis is another tool for analysing each cryptocurrency’s overall trends and potential based on its characteristics and current events.

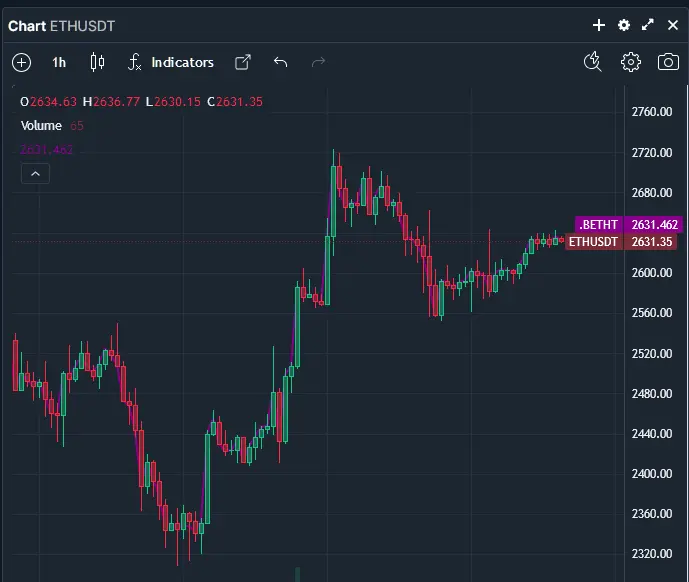

How to Find and Use Crypto Trading Charts

One tool for making crypto trading decisions is technical analysis. It involves evaluating the representation of prices and trading volumes on charts. The price is often visualised in Japanese candlesticks, as they provide a lot of information about the psychology of market participants.

Charts can thus be used to predict price movements or changes, define risk parameters, and help choose position entry and exit points. To do this, it is necessary to find a data provider that provides access to quality charts, such as the TradingView chart software, which allows relevant analyses to be carried out.

Technical analysis can also be used to determine where key risk areas are that could trigger cascading sell orders. Chart analysis often uses technical indicators that need to be selected and configured.

Relevant analysis tools and indicators

Technical analysis of cryptocurrencies typically relies on chart patterns (trend lines, support, and resistance areas), statistical indicators, or both. The most commonly used charts are candlestick, bar, and line charts.

Each can be created from similar data but present information differently. Some of the most common technical indicators include the average Directional Index (strength of a trend), Bollinger Bands, the Relative Strength Index ( RSI, magnitude of change), standard deviation, and moving averages (volatility). These indicators can help investors and traders profit from trends. Other statistical tools that investors can use for technical analysis of cryptocurrencies include Fibonacci ratios, Volume-Weighted Average Price (VWAP), and Time-Weighted Average Price (TWAP).

Pros and Cons of Crypto Trading

Depending on whether it is a short—or long-term strategy, the advantages and disadvantages are different, and the risks are very present.

Benefits of Crypto Trading

The main advantage of short-term crypto trading is that traders can earn high returns. Unlike traditional currencies, whose price changes rarely exceed 1%, digital currencies can experience significant fluctuations quickly. Prices can double in a matter of hours or overnight.

The main advantage of long-term cryptocurrency trading is that it is not very time-consuming. Long-term strategies often involve selecting cryptocurrencies with high potential (based on fundamental indicators specific to each) to hold them for an extended period, up to several years. Unlike day trading, which requires much time to follow the price evolution, long-term cryptocurrency traders can check the price evolution at much lower frequencies.

Another significant advantage of long-term trading is the ability to gradually buy digital currencies by adding them to the cryptocurrency portfolio. This allows you to build a portfolio gradually without having to tie up a significant initial capital.

Disadvantages of Crypto Trading

Due to the high volatility of crypto markets, the price of digital coins can fluctuate very quickly. This implies that to make profits through short-term trading, you must dedicate much time to market analysis.

The main disadvantage of long-term trading is that it is possible to take advantage of opportunities to make quick profits when prices go up and down quickly. In some cases, the cost of a cryptocurrency reacts to market forces and then falls back to its initial position, wiping out all profits in the long run.

What are the risks associated with cryptocurrency trading?

Investors are attracted to cryptocurrencies because of their high volatility. It is not uncommon for the price of a cryptocurrency to fluctuate by more than 10% in a matter of minutes. These fluctuations involve many profit opportunities and a very high risk of capital loss. Following strict money management rules can help limit this risk.

Cryptocurrency trading is often considered riskier than stock trading, but it depends on the stock or cryptocurrency and how the trader conducts their trades. The high volatility and usually unpredictable reactions of cryptocurrencies to various news events imply significant market risk.

Crypto Trading: New Fool’s Gold or Future of Trading?

Crypto Trading has become a popular activity for Traders due to the growing popularity of cryptocurrencies. Although it is, in many ways, similar to Forex Trading, trading digital coins is more complex due to the risks associated with its high volatility. Therefore, it is crucial for those interested in cryptocurrency trading to master the art of analysing market trends, following proven strategies, and managing the risks involved.

The cryptocurrency market is growing, and more traders and investors are interested. However, it is a complex and volatile market for which it is essential to be well prepared and have a solid strategy. In this section we will show you how to define your crypto trading strategy in three key steps.

Step 1: Determine your crypto investor profile

Evaluating your investor profile is essential to your investment strategy and, consequently, your financial success. Determining your investor profile means determining your risk tolerance when investing. In other words, before you set up your investment strategy, you must ask yourself what level of risk you are willing to take.

As a general rule of thumb when investing, the higher the return, the greater the risk. Determine whether you are comfortable with investments that can fluctuate in value quickly or prefer investments with guaranteed principal. This can help investors like you choose appropriate investments. For example, if you need to protect your money and your short time horizon, you can follow a more conservative strategy.

An investor profile summarises an investor’s financial objectives, financial situation, time horizon, and risk tolerance. If you are familiar with financial investments, you can directly write down your objectives (horizon, risk tolerance) and conclude to know your investor profile.

Otherwise, you can find standard questionnaires on many sites (including those of the AMF or banks and management companies) indicating your investor profile based on your answers. This will allow you to more easily sort the products in which to invest (stacking, farming, volatile altcoins, or bitcoin) and the strategies to favour (scalping, day trading, technical or fundamental analysis, etc).

Now that you know your investor profile, you are ready to move on to the next step in building your portfolio: investment type and strategy.

Step 2: Know the main crypto trading strategies

You need a proven strategy to make money in the cryptocurrency market consistently. A plan helps you stay focused amid the constant stream of news, economic data, and market events that can interfere with your analysis. Trading on intuition can be profitable occasionally but takes time to make consistently and long-term. Therefore, a strategic approach to trading is necessary.

A cryptocurrency trading strategy is an established method of planning and executing trades that you follow. Trading strategies typically define the specifications of what trades to make, when they should be made, when they should be exited, and the amount of capital you should risk in each position.

Your crypto trading strategy is a fixed plan you design to achieve positive returns when you buy or sell in the crypto markets.

There are many trading strategies, but we will focus on the most popular ones:

- Scalping is a popular trading strategy in the crypto market. This trading strategy allows traders to take advantage of small price movements at frequent intervals (positions lasting a few seconds or minutes) by using leverage and a tight stop loss to manage risk.

- Day trading involves entering and exiting positions within the same day. As such, day traders aim to take advantage of intraday price movements, that is, price movements that occur during a trading day. Day traders trade on higher time frames than scalpers but permanently close their positions within the same day. Day trading strategies are designed using technical analysis. Swing trading typically spans more than a day but not more than a few weeks or months. Therefore, some consider this a medium-term trading strategy because it falls between day trading and position trading strategies, giving traders more time to think about their decisions.

- Position trading allows traders to hold positions for extended periods (hodler). This can be months or even years. Traders who use this strategy typically ignore short-term price movements and focus more on long-term trends. Position traders also use fundamental analysis to assess potential trends in market prices and consider other factors, such as market trends and historical patterns.

- The practice of buying cryptocurrencies on one exchange and selling them on another exchange to profit from price differences is known as arbitrage trading. The trader makes money by taking advantage of the difference in quotes between multiple exchanges.

The cryptocurrency market is becoming increasingly professional (robots), but arbitrage opportunities persist. Beyond trading strategies, cryptocurrency investors can also turn to stacking and farming platforms to obtain passive income (which is not without risk; the money placed in a cryptocurrency can collapse and induce a loss greater than the interest received).

Step 3: Define your crypto strategy and money management

Your personality and the time frame you choose to trade in will determine your trading style. When developing a trading strategy, the amount of time you plan to spend trading is an important consideration.

No “best” trading strategy can be generalised and work for everyone, as it depends on each trader. Instead, the “best” trading style is the one that works for you. Developing a cryptocurrency trading strategy that suits your financial goals and personality type is no easy task.

After reviewing your investor profile and some of the most popular crypto trading techniques, you should be able to determine which one will work best for you. Keep a journal in which you record the results of your trades to quickly decide which ones are genuinely successful and which are not. To do this, carefully follow your predefined rules and take notes on the results of each of your strategies.

Cryptocurrency trading is very profitable when done right. However, if done wrong, you can incur significant losses, some of which can never be recovered. Therefore, there are some excellent trading habits that every trader should practice.

One of these habits is having a money management plan. Like in any other profit-oriented business venture, money in cryptocurrencies is a valuable asset that must be managed critically using a money management strategy. Money management is a financial strategy determining how traders invest their money in different crypto assets. It also determines when a trader will enter a trade, how much volume they will buy, and when they should end their day.

Money management helps you navigate the pressure of trading in the financial markets smoothly. It teaches you patience and tolerance, and most importantly, it aims to protect your main working tool: your trading capital. With these 3 simple steps, you can start developing a strategy that suits you regarding risk profile and investor with strict money management. You will then be able to write a trading plan that you will refine as you test it based on the most successful strategies that suit your profile. Finally, all you have to do is stick to it firmly!

Frequently Asked Questions:

What is crypto trading?

Crypto trading involves buying, selling, or holding cryptocurrencies to profit from price fluctuations. It can be done on dedicated platforms where traders exchange fiat currencies or other cryptocurrencies.

How do I get started with crypto trading?

To start crypto trading, choose a reliable exchange platform, create an account, verify your identity, and fund your account. Develop a trading plan and familiarize yourself with strategies, risk management, and security practices.

What are the risks of crypto trading?

Crypto trading is highly volatile and can lead to significant gains or losses. Risks include market volatility, security breaches, and the potential for account hacking. Proper risk management and security measures are essential.

What are the main strategies in crypto trading?

Common strategies include scalping, day trading, swing trading, and position trading. Each strategy has its own timeframes, risk levels, and techniques for analyzing the market.

How can I secure my crypto trading account?

To secure your account, use strong passwords, enable two-factor authentication (2FA), and choose reputable exchanges. Regularly update your security settings and be cautious of phishing attempts and suspicious links.